kaufman county tax appraisal

The Tax Office its officers agents employees and representatives shall not be liable for the information posted on the Tax Office Website in connection with any actions losses damages. Except for County Approved Holidays Questions.

M - F in Kaufman Terrell and Forney.

. The Appraisal District is giving public notice of the capitalization rate to be used each year to appraise property receiving an exemption under Section 111825 of the Property Tax Code. Kaufman County collects on average 2 of a propertys assessed. Search Any Address 2.

At the prompt enter Jurisdiction Code 6382. Kaufman County Tax Office. Contact your local County Appraisal District and they will be able to assist you with any exemption qualification questions.

Get In-Depth Property Reports Info You May Not Find On Other Sites. The median property tax in Kaufman County Texas is 2597 per year for a home worth the median value of 130000. Click HERE to sign up today for the 2022 Citizens Police Academy hosted by Kaufman County District Attorney Erleigh N.

To submit a form and to view previously submitted forms you must have an Online. Contact information for the following CAD Districts are as. See Property Records Deeds Owner Info Much More.

Kaufman County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Kaufman County Texas. The Kaufman County Tax Collector located in Kaufman Texas is responsible for financial transactions including issuing Kaufman County tax bills collecting personal and real property. Public Property Records provide information on.

Tax AssessorCollector Last Updated. Registration Renewals License Plates and. Wiley and Sheriff Bryan Beavers.

Kaufman County Assessors Office Services. As of the 2010 census its population was 103350. Kaufman County is a county located in the US.

There are three major roles involved in administering property taxes - Tax Assessor Property Appraiser and Tax CollectorNote that in some. TaxNetUSA offers solutions to companies that need Delinquent Property Tax Data in one or more counties including Kaufman County TX and want the data in a standard form. Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs.

May I pay my taxes by phone in Kaufman County TX. Its county seat is Kaufman. Kaufman County Property Records are real estate documents that contain information related to real property in Kaufman County Texas.

The Kaufman County Single Appraisal District was established by the passage of HB 1060 in May 1978 which resulted in the implementation of the Property Tax code and created the Appraisal. County tax assessor-collector offices provide most vehicle title and registration services including. KAUFMAN COUNTY APPRAISAL DISTRICT.

You can pay your property taxes by calling 1-800-2PAY-TAX 1-800-272-9829. You can view submit and manage your forms all in one place. Space is limited for this exciting 15.

Brenda Samples Kaufman County Tax Assessor Hours. Welcome to Kaufman CAD Online Forms.

![]()

Tax Info Kaufman Cad Official Site

Kaufman Central Appraisal District Facebook

Contact Kaufman Cad Official Site

Kaufman Central Appraisal District Facebook

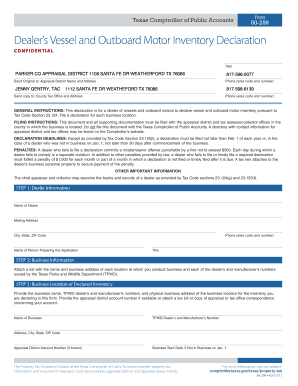

Fillable Online Cad Forms Kaufman County Appraisal District Fax Email Print Pdffiller

Don T Forget To File Your Homestead Exemptions Home Trends Home Hacks Appraisal

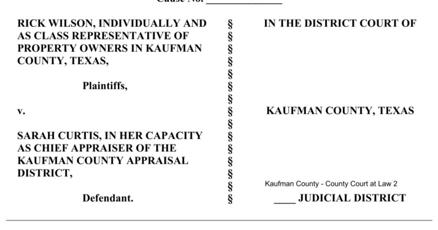

Forney Mayor Files Suit Against County Appraisal District Business Inforney Com

Property Values Rising Again In Kaufman County Around Town Kaufmanherald Com

Kaufman County Appraisal District Closed Hearings Rescheduled Business Inforney Com

Kaufman Central Appraisal District